The path to recovery requires discipline and the changing of old habits, one being the adjustment on how you spend and manage your money. With Life Skills being such an important and impactful focus for a structured recovery and sober living program, having Financial Literacy as part of the Life Skills resource for your client’s will help them get their financial footing back on track, and avoid a stressful trigger which could influence a relapse in recovery.

How do people’s financial health get affected during their battle with addiction? A couple of the factors are:

- Missed Mortgage or Rent payments

- Missed Car payments

- Lost Job

- Accrued legal fees

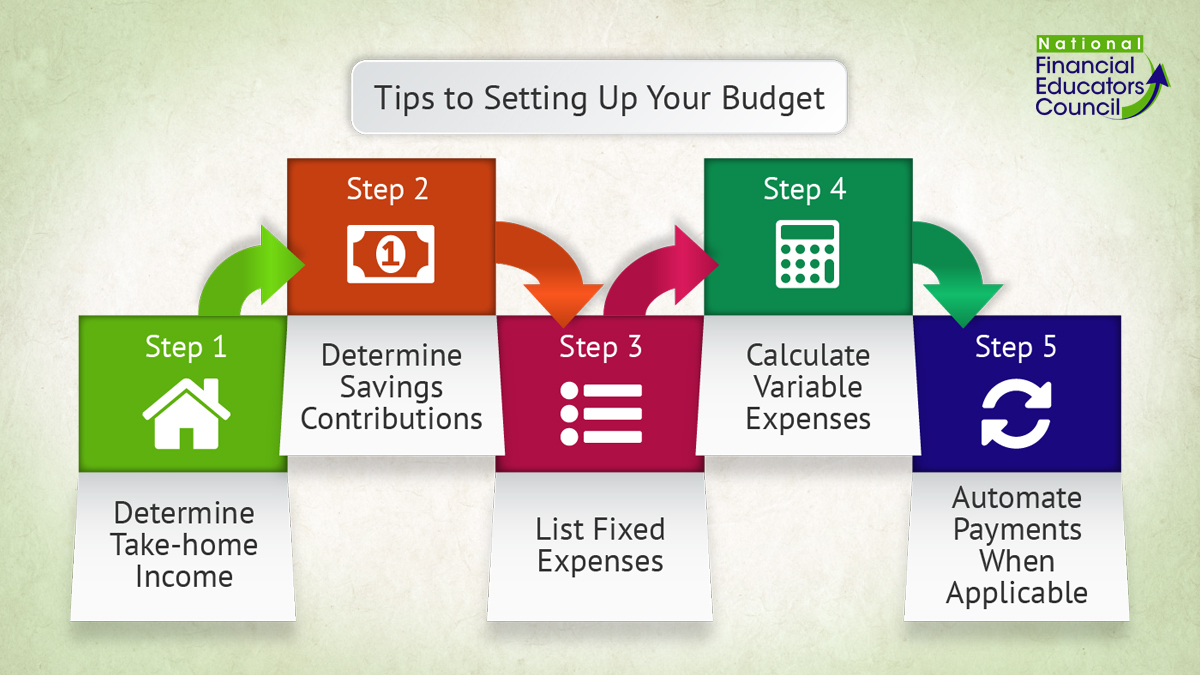

Focusing on rebuilding the financial hits your clients took prior to recovery will require the clients to start their financial recovery plan by starting small, and setting goals. Your client will want to make a list of goals, and prioritize them in order of importance. The first focus should be on getting employment to start getting a steady income. Once the client has a steady and predictable income, they can use this information to create a budget and start tackling other items on the financial recovery goals list.

After getting a job, understanding your income, and setting a budget to cover rent and other recurring expenses, your client should start working on rebuilding their credit and opening a bank account. Opening a bank account and utilizing a debit or credit card will help with tracking spending, budgeting, avoid dealing with cash, establishing savings and start a positive payment history to help rebuild your credit score. There are a couple great banking and card options for folks in recovery and we will be sharing more resources with you in the coming weeks to help with this Life Skills initiative.

The Steps:

- Get employment: build your resume and get a job

- Understand your income, and your monthly expenses: How much you take home / how much your expenses are

- Create Budget for your expenses: Rent, Utilities, Groceries, Other Bills, Savings

- Open Bank account and credit card account: Monitor spending and avoid cash

- Make Payments on time: build positive payment history, good habits and build credit

A big piece of the financial rebuilding puzzle is rebuilding your credit and activating a banking account. Since your credit may have been damaged and your bank account closed prior to your recovery journey, it may seem difficult to get another card but there are options! Here are some highlights on two of the best options in this situation: the secured credit card and a prepaid debit card:

The Secured Credit Card

- Will help you rebuild your credit!

- Credit scores of all ranges approved

- Requires a refundable deposit of sorts in order to activate the card

- Requires you to have an active bank account

- May have annual fees

The Prepaid Debit Card:

- Doesn’t help you rebuild your credit, in most cases

- No credit check required

- No bank account required, pseudo bank account provided with acct/routing number

- Help with budgeting

- Allows direct deposit, government benefit deposit

Providing financial literacy information and resources to your clients is a great way to differentiate your program. NARR ( National Association of Recovery Residences ) even requires that Life Skills be a part of any Level III program, however even if your recovery residence doesn’t fall into this category you should still consider providing some Life Skills to your clients. Why not have your Life Skills focus on Financial Literacy? Many accreditation organizations, whether a professional association or a government agency will want to get reporting on how your client’s are progressing with Life Skills so providing these financial literacy resources to your clients will not only benefit them but also your organization overall.

Do you want to add financial literacy to your Life Skills resource for your clients? Reach out to me at emmanuel@onestepsoftware.com and we can help with this initiative! Stay tuned for an invitation to an upcoming webinar next month on ‘Digital Payment Processing & Financial Health for Clients’.